Fully automated safe deposit box systems

Additional information > The fundamentals of precious metals – a broad introduction to the basic principles > Encyclopedia – Automated safe deposit systems

What are fully automated safe deposit box systems?

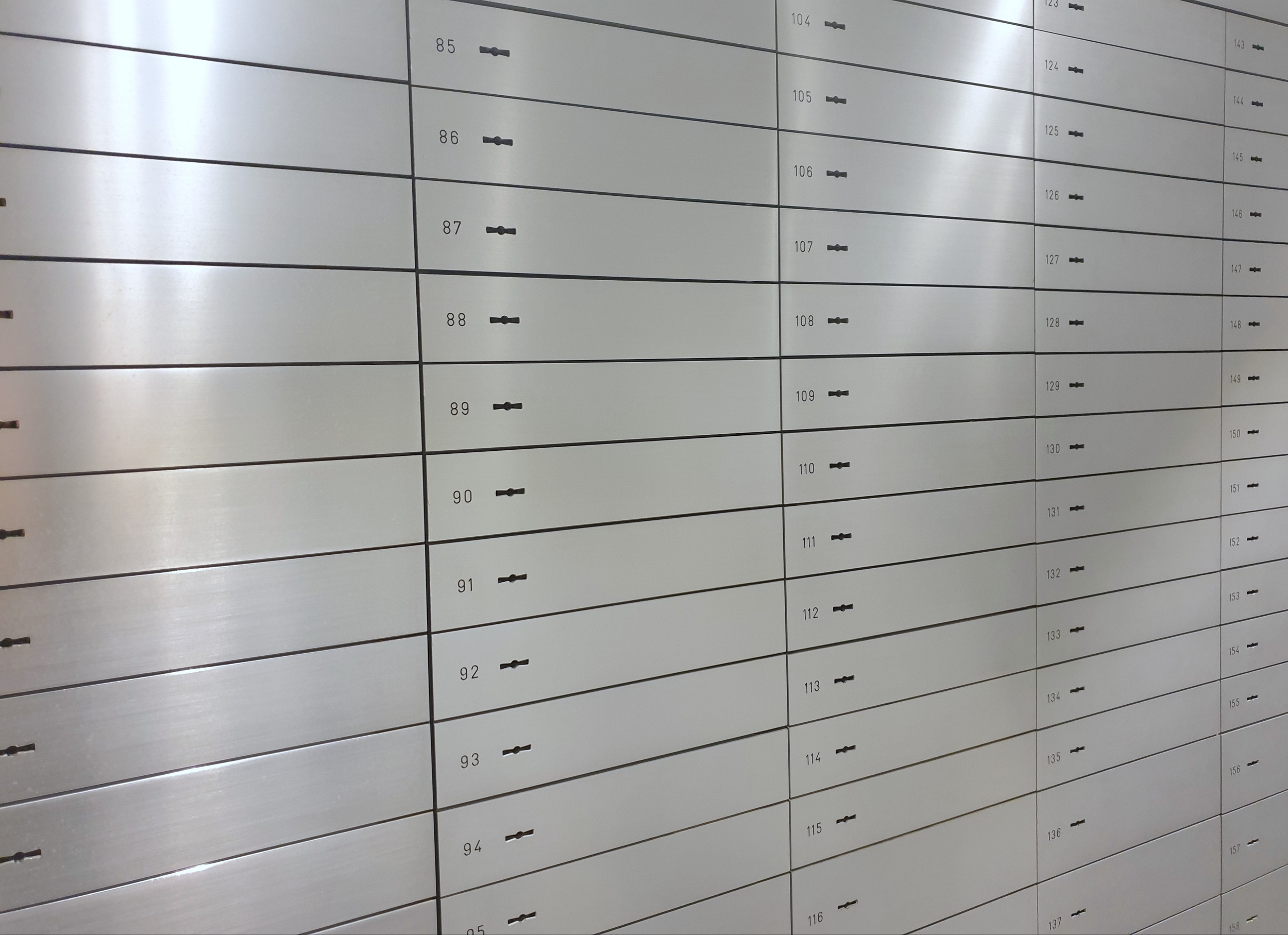

In the past, safe deposit box systems were generally mechanised with facility access usually achieved via some kind of key combination lock. In this context, a staff presence was absolutely necessary in order to allow customers proper access to the contents of their safe deposit box. Nowadays, however, there is also an option to use an automated safe deposit box system. This kind of fully automatic safe deposit box facility is now available at many banks, with many bank-independent safe deposit box providers also operating similar systems.

These automated systems enable customers to securely store all kinds of valuables: from important documents through to artworks, watches – even precious metals and share certificates. Fully automated systems have a number of benefits: Because they feature robot automation, they permit round the clock access. And, apart from the security personnel required to welcome customers upon entering the system, no further operating personnel are required. This is because safe deposit box contents can be automatically transferred to customers once they enter a secure room. But how exactly does this system work?

© Swiss Gold Safe AG

How fully automated safe deposit box systems work

Thanks to digital processing, using a fully automated safe deposit box is usually less complicated than using a classic bank safe deposit box. In many cases, the process begins with a customer registration procedure, which can often be done online or via a dedicated app. So it usually takes much less time to do this than it would to access the traditional safe facilities offered by banks.

And unlike the majority of such traditional arrangements, customers can usually access these new systems 24/7. This gives them maximum flexibility when accessing their valuables and documents.

How are users of automated safe deposit box systems checked?

Access authorisation authentication

Whenever an automated safe deposit is accessed, or the contents viewed, access authorisation is checked and verified using two-factor – or perhaps even three-factor – authentication. This is a multi-stage, part-biometric process used to verify authorised persons.

The initial authentication is a check to allow an authorised person to enter the building or premises which houses the automated safe deposit system. Access is usually achieved via a personalised ID card sent to a customer in advance. Having used this card to entering the building or premises, the entrant will then be received by a customer advisor at the reception desk, or may perhaps carry out the subsequent security steps entirely independently. The exact process used will depend on the facilities and requirements of each respective service provider.

To enter a private and secure customer space, the personalized ID card must be scanned again before entering a secret pin known only to the customer. After these checks, the door can be opened to allow the customer to enter the self-service area.

A third authentication is then required to access a personal safe deposit box within the secure customer space: This step requires the ID card, the personal PIN, and sometimes a biometric fingerprint too. If all three authentications are successful, an automated process designed to retrieve the safe deposit box assigned to the customer will then begin.

Robot support for safe deposit box transport

Unlike conventional safe deposit systems, the customer does not have access to the vault housing the safes. Instead, a robot drives through the vault to the customer’s own safe deposit box, takes it off the shelf, and transports it to a lock-gate connected to the secure customer space. The customer receives the safe deposit box via the lock-gate and can then open it (usually with a physical key) and thus access the contents.

Once customers have completed the desired action, they can return the locked safe deposit through the lock-gate. A robot will then automatically transfer the safe deposit box back to its correct place on the storage shelf.

Security guards

Whether or not a security guard is also present when the customer enters the safe deposit system will depend on the operating practice of each respective service provider. If any security guard is present, their job will be to ensure no unauthorised persons approach and compromise the privacy and security of the process. Almost all automated systems can be accessed around the clock, including weekends.

What security risks do fully automated safe deposit box systems present?

However practical an automatic safe deposit box may seem, with its quick and easy registration, and 24/7 access for 365 days a year, its security can sometimes be compromised. The extensive reliance upon automation can in fact create new risks that simply do not exist in classic safe deposit box systems. One significant risk is hacking – the unauthorised manipulation of the IT facilities in use on automated premises. This technique can allow safe deposit boxes to be robbed without the need to break into a physical vault. If hackers can successfully breach the IT security protocols of an automated safe deposit box system, they can easily request access to one safe deposit box after another, stealing the contents more or less at their leisure. Whether you choose a 24-hour safe deposit box or a traditional system, it’s essential to pay careful attention to the security arrangements to ensure your assets are protected by safe system providers who employ the highest possible security standards. The following two incidents illustrate that some security systems are anything but foolproof:

Safe deposit box theft in Basel

At the Aeschenplatz Raiffeisen bank in Basel, criminals emptied 22 safe deposit boxes held in a fully automated safe deposit system. Apparently, the thieves managed to manipulate the automated 24-hour safe deposit boxes. These safes were supplied by a well-known manufacturer and thus were by no means ‘budget’ models. Customers were allocated a safe deposit box and supplied with an access card and a personal identification number. This authorised them to make automated retrievals from a secure storage room.

Safe deposit box thefts in Saarbrücken and Mainz

A similar incident happened in Germany at the Sparda-Bank Saarbrücken. Here, thieves again managed to outsmart a fully automated safe deposit box system and clear out the contents of several customer safe deposit boxes. At the same time, another group of criminals managed to plunder safe deposit boxes at the Sparda branch in Mainz. Both incidents involved fully automated safe deposit box systems.

Secure alternatives to fully automated safe deposit box systems

The accessibility of fully automatic safe deposit box systems is an impressive feature. However, this same convenience is also possible at traditional facilities like the Swiss Gold Safe bank-independent vault in the Gotthard region. Swiss Gold Safe also maintains another modern high-security facility in the Principality of Liechtenstein for storing valuables of all kinds. While these facilities are not automated, they are accessible at any time, after prior notification. This personal support available to each client significantly increases the level of security as compared to that available within any fully automated system.

In addition, the mandatory prior appointment to arrange safe deposit box access ensures no unauthorised persons can gain unwarranted access, and also guarantees the procedure is implemented with maximum discretion.

Summary

- An automated safe deposit box is usually available to customers 24/7, 365 days a year.

- Access is usually via three-factor authorisation, but criminals can still breach the system.

- Fully automated safe systems in Germany and Switzerland have recently been manipulated or hacked by criminals on several occasions.

- A 24-hour safe deposit box usually permits customer access without the presence of safe-deposit personnel.