Rare earths – an investment product?

Additional information > The fundamentals of precious metals – a broad introduction to the basic principles > Rare earths as an investment product

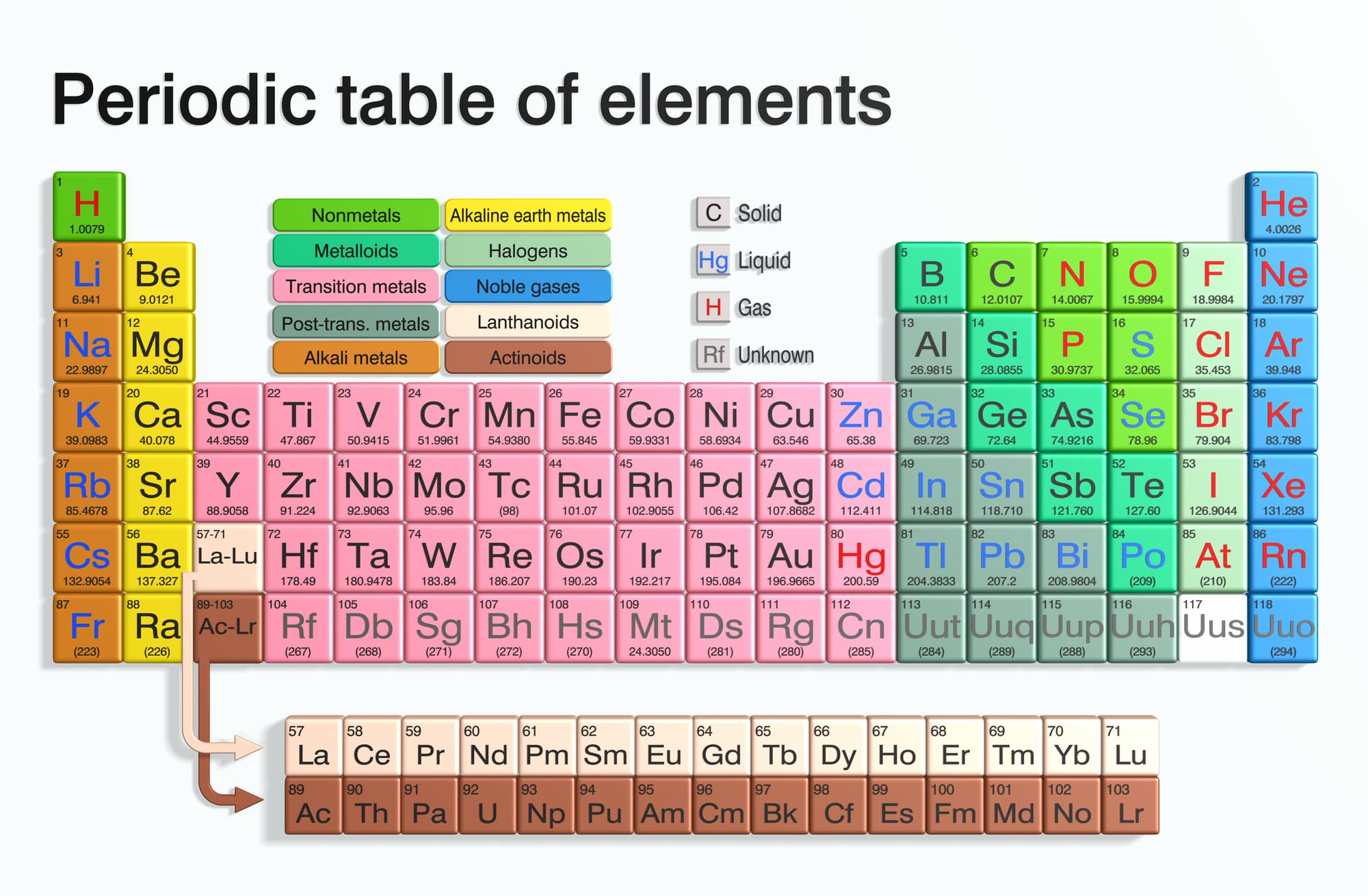

A set of 17 elements are described as rare earth metals, and thus appear in the periodic table of elements. However, this term is misleading, because many of these pure substances are found more frequently in the earth’s crust than gold or platinum, for example. These raw materials are primarily used in industry where they are much in demand.

Rare earth metals – also called Rare Earth Oxides (REO) – have been known in Europe since the 18th century. The term “rare earth elements” was coined at this time, because their discoverers assumed their occurrence should be classified as rather limited. Furthermore, they are oxidized from minerals, which is why the term “earth” was used, this being an older term for oxides.

Rare earth elements are relatively soft, silver-coloured metals. And like silver and other white metals, they tarnish quickly when exposed to air. They offer strong electropositivity and low conductivity, and some of these metals have special functions. For example, gadolinium adheres to magnets in a similar way to iron, and lanthanum has superconductor properties.

Rare earths always occur together, never alone, and they tend to appear in combinations as groups of similar elements. For this reason, these 17 earth elements can be roughly divided into two sub-groups of cerite earths (atomic numbers 58 to 64) and ytter earths (atomic numbers 65 to 71). A distinction can also be made between light and heavy rare earths.

Rare elements in the periodic table

On average, the light rare earth elements lanthanum (57), cerium (58), praseodymium (59) and neodymium (60) account for more than 95 percent of rare earth metals. The rest occur in much smaller proportions, and comprise a group consisting of the heavy rare earths scandium (21), yttrium (39), promethium (61), samarium (62), europium (63), gadolinium (64), terbium (65), dysprosium (66 ), holmium (67), erbium (68), thulium (69), ytterbium (70), and lutetium (71). With the exception of scandium and yttrium, all earth elements follow lanthanum in the periodic table of metals, which is why they are called lanthanides, or lanthanoids.

© Stefan Yang - stock.adobe.com

What are rare metals?

Rare metals can be found in the periodic table of elements alongside light and heavy rare earth elements. They are transition metals characterised by their special ability to oxidize (electron transfer reaction), and generally form coloured compounds. The best-known transition metals include niobium (Nb 41), tantalum (Ta 73), cobalt (Co 27), indium (In 49), zirconium (Zr 40), gallium (Ga 31) and the alkali metal lithium (Li 3). Due to their predominantly low melting points, rare metals are used in industrial production, for example as alloy additives employed to produce stainless steels.

Unlike rare earths, the rare metals share few things in common with each other. This can be deduced, for example, from the fact that they are not located next to each other in the periodic table of elements (see above). When extracted by traditional mining methods, niobium and tantalum often occur together. Cobalt is often obtained as a by-product of copper and nickel mining. Gallium and indium products are more likely to be recovered during the extraction and refining of aluminium and zinc.

With the exception of lithium index funds (ETFs), these rare metals are not listed as raw materials on the stock exchange. So their prices are determined exclusively by market demand. Lithium in particular is one of the most sought-after raw materials. Among its other properties, lithium is considered the key to e-mobility thanks to its critical role as a car-battery component (lithium-ion cells). Many processing companies regard this light metal as a prestige product, which is why it is often referenced in advertising campaigns. Globally, around 82,000 tons of lithium are produced every year – and this trend is set to increase. As much as 58% of global lithium production demand is presently concentrated in China.

The difference between rare earths and rare metals

Rare earths and transition metals are elements that occur frequently in nature, but rarely in sufficient concentrations to sustain economical mining projects. Classic mining techniques can be used to extract both these groups of elements. However, the extraction processes employed to recover the final end products vary greatly in their complexity. Various hydro-metallurgical processes are used, followed by chemical reagents. So the essential differences between rare earths and rare metals occur at the processing stage, and again in the varied usage of the end products.

Where are rare earths mined and processed?

Rare earth elements do not occur as pure metals or oxides, but have to be extracted from ores. They are found as a compound substance, particularly in the minerals bastnaesite, monazite and xenotime. Their occurrence is mainly concentrated in Australia, Brazil, China, India, Madagascar, Myanmar, Russia, Thailand, USA and Vietnam. More than half the world’s production comes from the Bayan Obo mining district in China’s Inner Mongolia. Other mines important to the world market are Mountain Pass in the US state of California and Mount Weld in Western Australia.

According to Statista*, around 240,000 tonnes of REO were mined worldwide in 2020. China accounted for 140,000 tonnes of this total, while the USA contributed 38,000 tonnes. Significant amounts were also mined by Myanmar (30,000) and Australia (17,000). For European industry, this creates a further dependence on China as an important trading partner.

Rare earths are usually processed directly inside the mines, and at certified refineries. Since these individual metal elements are remarkably similar and can often only be distinguished by weight, the separation process is particularly complex. The pure proportion of rare earth metals extracted from the original ore is between 30 and 60 percent, depending on the mineral classification. In addition, the processing technology is subject to strict environmental regulations, because the rocks contain a low concentration of the radioactive element thorium (90) and other toxins.

The industrial applications of rare oxides

Rare metal oxides are required in many branches of industry, and tend to be used wherever powerful permanent magnets are required. The main areas of application are wind turbines, electric vehicles and magnetic resonance tomographs. However, these chemical elements are also in widespread use in media technology products, such as headphones, loudspeakers and plasma screens, as well as in notebooks, smartphones and daylight LED headlights.

Experts assume that the future belongs to terbium, dysprosium, neodymium and the like. High-tech applications such as the 5G mobile communications standard or modern X-ray technology would no longer be feasible without rare earth metals. In addition, the use of renewable energies cannot be implemented without the use of high-performance raw materials. Thus the demand for these elements is likely to increase further in the coming decades.

Which rare earth metals attract investor interest?

The four rare earths dysprosium, neodymium, praseodymium and terbium are of fundamental importance for industry, and are thus in use worldwide. And due to this high global demand, these strategic metals also represent important investment products, especially given the high value density of the isolated oxides. Rather like gold or silver, they never lose their value and can always be re-processed to create new products. Cast as ingots or in powder form, these rare earth oxides are ideal for storage and can be further processed by almost any branch of industry.

© RHJ - stock.adobe.com

Investment in mining company shares is already widespread today. And beyond this, investors can source special equity funds and index certificates in the rare earth market. Direct investment in physical oxides via metal traders has also become an increasingly viable option. Trading companies offer bundles in different denominations, for example in lots of one or ten kilograms. While these are mainly sold to industry, they are also purchased by private investors.

Purchasing rare earths is an alternative form of investment, and these tangible assets may offer some advantages over the purchase of shares or other precious metals. Rare earth oxides are not often traded on the stock exchange, so their price mostly depends on the forces of supply and demand in the spot market.

- Pay attention to the original packaging: Experts advise investors to purchase rare earths as oxides in powder form with a high purity rate of 99 percent. The industry generally prefers this commercial format because it has excellent storage properties and can then be further processed as required. Conventional batch sizes in their original packaging are also important because they usually include essential quality analyses and details of origin. Where this information is unavailable, prospective owners must expect significant discounts when selling on their holdings at a later date.

Price development in recent years

Although rare earth elements have not yet become common investment products, a new asset class could be emerging, and the price development over recent years would seem to confirm this view. However, unlike gold and silver, there are no price overviews for rare earths due to the lack of market data. So the price development can only be shown as a percentage plus approximate valuations. The actual prices will invariably depend on the purchase quantity and the current demand. So when selling rare earths, there remains the possibility that no buyer might be found, especially when marketing large quantities. Investors must take this into account when making their investment decisions.

© Björn Wylezich - stock.adobe.com

Proper storage is all-important

As with all other material assets with a high value density, professional storage and appropriate insurance cover is recommended for rare earths as an investment product. This can be arranged in Switzerland outside the banking system, for example, with Swiss Gold Safe, a specialist storage company. Here, investors can arrange segregated storage for their rare earths. This means investors will always be able to retrieve the exact same products they originally consigned to storage. This is particularly important in the case of rare earth metals where owners must be able to deliver the high quality demanded by industrial users.

In addition, Swiss Gold Safe also offers rare earth storage in duty-free warehouses. This enables investors to buy, sell and store their holdings free of VAT – regardless of the holding period.

- Are you planning to invest in rare earths and looking for a professional storage company? Then let Swiss Gold Safe advise you on the options available.

Rare earths: an overview

- The 17 rare earths are listed in the periodic table of chemical elements.

- Rare earths occur in the minerals of the earth's crust in combination with other metals.

- The main producers are: China, USA and Australia. Rare earth metals are processed at the mines immediately after extraction.

- These oxides are used in many industrial sectors, such as wind energy, automotive engineering and high-tech manufactured products.

- The demand for strategic metals such as dysprosium, neodymium, praseodymium or terbium, which also appear on the market as physical investment products, is correspondingly high.

- Apart from lithium funds, rare metals are less well-known as investment products. These elements are transition metals which are primarily used to protect steel products from corrosion.

- Among all the rare metals, lithium is the one most sought-after by industry. Among other things, it is an essential component in the production of long-life car batteries.

- Professional storage in the original packaging ensures the value retention and unrestricted onward sale of rare earths purchased as investments.