Store cash – protect company capital, avoid negative interest rates

Additional information > Services, clients and facilities > Store cash – protect company capital, avoid negative interest rates

- This article gives you information about storing cash as an institutional customer. Switch to this article if you are a private individual: Cash storage as a private customer.

Storing cash avoids penalty interest and deposit fee

The days when banks used to pay their customers interest on their credit balances are long gone. Instead, businesses that have performed well are asked to pay up when their company’s capital exceeds a given allowance threshold – something which applies to many firms. Such a negative interest rate causes high costs and limits the investment capability of businesses. An account holder also bears a counterparty risk with his or her bank. Indeed, in the event of bankruptcy, this is only indemnified up to the upper limit of the deposit guarantee.

It can be particularly important for companies and organisations to be able to dispose of some of their assets at short notice or even immediately. For example, this might be to meet current debt obligations, to react to changing market conditions without any hesitation or to remain competitive at all times. The hoarding of cash away from bank accounts, with the penalty interest that can accrue there, can consequently represent a viable alternative.

According to statistics from 2019, Switzerland has a cash volume of around 80 billion Swiss francs. If a run on the banks were to occur, then – given the country has a good 8.5 million inhabitants – every Swiss person would receive a mere CHF 9,500.

Storing money in your own safe – is it a good hiding place?

When it comes to storing cash, a company director may well think that their business headquarters is a good place. After all, the cash reserves would almost always be available and there would be no negative rates to worry about. That said, security measures should be taken into consideration. Is there an alarm system that ideally informs the nearest police service or a private security company in the event of a burglary? Does the building itself provide adequate protection against theft? Is there sufficient insurance to cover a break-in? How do you delegate the access rights securely and without fraud being committed in your company? Very few firms can answer all these questions satisfactorily.

The alternative – a bank’s safe deposit box?

Therefore, it makes sense to withdraw the cash assets from the business account and place them into a safe deposit box at a bank instead. This step obviously eliminates the need for potentially expensive security systems. However, here too, there are questions to ask of insurance and access delegation.

The solution: an insured, bank-independent storage provider

Bank-independent storage of cash assets may well be the optimal solution you are seeking. Such services are offered in the privately managed and high-security facilities of Swiss Gold Safe in Switzerland. Easily accessible by private vehicle or public transport, your cash will be securely and discreetly stored in safes. Always offering access to your cash, the facility removes you from the risk of defaulting, a banking crisis and, of course, negative interest rates. The stored cash remains the property of the customer – even in the unlikely event of the bankruptcy of the warehouse provider. This is because, according to the Swiss Code of Obligations, the stored assets are not part of the storage provider’s balance sheet.

Swiss Gold Safe is your specialist service provider when it comes to professional and secure storage. We offer our institutional clients a fully insured solution that is individually tailored to their particular needs. Enquiries about our terms can be directed to our specialist cash deposit team.

Free consultation or questions? Contact us

Storing Swiss Francs, what does this require?

Physical banknotes need space, especially when it comes to large sums of money. In addition, the face value of the notes being stored needs to be taken into account along with the space requirement of the cash itself. Swiss business customers have it much easier than their competitors in this regard compared with other countries. This is because the high denominations of banknotes in Switzerland reduces the storage volume that is required. The second most valuable banknote in the world is the CHF 1,000. By comparison, the highest banknote of the European Union (EU) is the 200 Euro note. The American dollar is only available in 100 dollar bills at the most. Storing Swiss Francs is, therefore, so much easier than stowing away either Euros or US dollars.

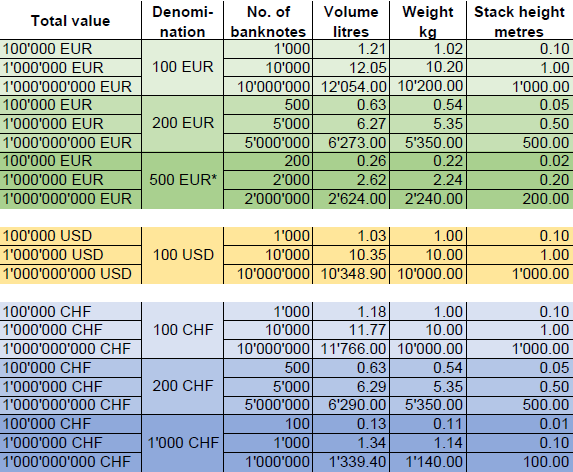

In our overview, below, we have compiled volumes and weights for three currencies: Swiss Francs, Euros and US dollars. The three orders of magnitude are 100 thousand, 1 million and 1 billion . The measures and weights are based on current values of the European Central Bank (ECB), the Swiss National Bank (SNB) and the US Federal Reserve.

* This banknote has not been printed since the end of 2014 but remains official legal tender.

Summary: Storing Cash

- Companies rely on short-term cash reserves to service their ongoing costs and to maintain their competitiveness.

- But instead of receiving interest rates, negative interest rates are applied. Companies also bear a counterparty risk in the event of bank defaults.

- Storing cash in a safe deposit box or in-house is a possibility, but this involves considerable risks.

- A fully insured and bank-independent cash deposit rented in the private, high-security facilities of Swiss Gold Safe Ltd in Switzerland is an alternative. The stored cash always remains the property of the customer and is free from penalty interest charges.

- Swiss customers have an advantage when it comes to safely storing cash thanks to the high denominations of notes that are available. Storing US dollars or Euros requires significantly more space.