Platinum coins – the exotics of collector coinage

Additional information > Investment forms for gold, silver, platinum and palladium > Platinum coins – the exotics of collector coinage

The history of platinum coins

For a long time, platinum was not even considered to be a precious metal, and certainly not a substance which was at all suitable for coin production. The Spaniards, for example, viewed platinum just as a by-product of the gold production process and, at best, considered it to represent that yellow metal at a very early stage in its formation. That’s why they called it “unfinished gold”. It was only in Russia in the 19th century that platinum coins began to be used as payment in transactions.

It was the Demidovs, a Russian noble family who had made their fortune by mining silver ore, who came up with the idea of using platinum as a metal for minting coins. Count Demidov’s family owned large estates in the Urals and, after finding platinum nuggets in various rivers, they were seeking a way to convert their discovery into money. The family approached the Russian Count Georg von Cancrin, then serving as finance minister to Tsar Nicholas I, and managed to convince him of the merits of the idea.

The Tsar was quickly won over to the scheme and shortly afterwards arranged to have a regular supply of platinum coins minted. So from 1828 to 1845, Russia circulated platinum coins of 3, 6 and 12 rubles, also known as “platinum ducats”, which were used for transaction payments. Meanwhile, silver ruble coins, which were also used as a means of payment in Russia at that time, were known as “white ducats”.

© tapper11 - stock.adobe.com

Platinum ducats in denominations of 3 silver rubles were the same size as silver 25-kopek coins. Nevertheless, they were easy to distinguish from one another, because the relative density of platinum is almost twice that of silver. The platinum coins weigh 2 zolotniks and 41 doli, where 1 zolotnik is 4.265 g and 1 dola is 0.044 g. This weight, and the inscription “pure Ural platinum”, were stamped on all platinum coins. The three-ruble coin itself weighs 10.35 grams, and platinum rubles contain around 97 percent platinum.

The coins were never particularly popular with the Russian people, mainly because of the appearance of the metal which was a matt colour. In the vernacular speech of the time, the coinage was somewhat contemptuously usually referred to as the serinkie (the greys). By contrast, the rural population did favour these inconspicuous platinum ducats, because the coins were found to survive unscathed whenever wooden houses, which were very common in country areas at this time, happened to catch fire. The practical explanation for this phenomenon lies in the fact that platinum metal has an extremely high melting temperature of 1770 degrees Celsius.

Producing platinum coins was very complex process during this period, which is why this coinage was eventually discontinued in June 1845. And for six months, the general population was then permitted to exchange the coins for an equivalent amount of silver or gold coinage. As a result, almost 80 percent of the platinum coins in circulation at that time were withdrawn and subsequently melted down. This also explains why platinum rubles are extremely rare today, and thus always command a very high price.

Where can investors or collectors buy platinum coins?

Platinum coins can be bought from various banks or from a number of specialist numismatic traders . Coin prices will vary according to the provider. The coin trade is also an option if coins have to be sold again – if, for example, an investor wishes to convert a holding back into cash or wants to take advantage of a considerable increase in their market value. Alternatively, precious metal dealers, jewellers or precious metal exchanges advertising on the Internet also accept platinum coins as part-payment. However, you should always carefully compare prices before selling coins through any of these channels.

Popular platinum coins at a glance

The Platinum Ruble

Russia brought its platinum ruble coinage into circulation between 1828 and 1845. These coins were valued at 3, 6 and 12 rubles, and weighed 10.3 grams, 20.6 grams and 41.2 grams respectively. This coinage is presently in great demand among both investors and keen coin collectors. And since that demand is inevitably far greater than the available inventory, further increases in value are to be expected.

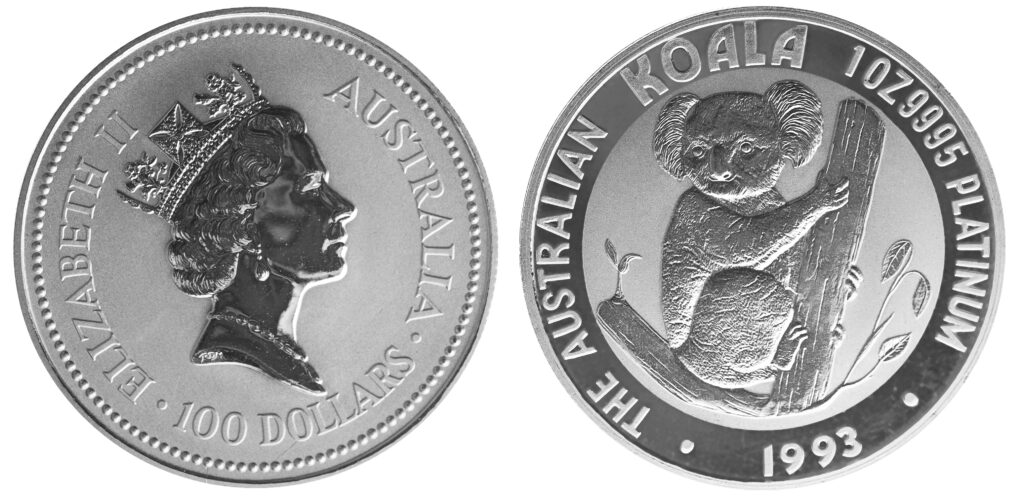

The Platinum Koala

© Lovrencg - stock.adobe.com

The Platinum Koala is an Australian bullion coin which is also popular with collectors and investors. This investment coin was minted between 1988 and 2000 and is available in different weights from 1/20 ounce up to 1 kilogram. The price is based on the current price of platinum quoted on the commodity exchanges. An image of Queen Elizabeth II of England is embossed on one side, while the koala design image on the reverse of the coin was changed every year.

The Platinum Noble

This coin comes from the “Isle of Man”, one of the British Isles. The first platinum coin specifically created for investors, the Platinum Noble was minted from 1983 to 1997. The front of the coin shows an image of Queen Elizabeth II of England, while the reverse face shows the denomination and depicts a Viking ship. This coin is available in weight units from 1/20 to 1 ounce, and its annual circulation, set at a maximum of 10,000 coins, was often quite appreciably less than this figure. The Platinum Noble is traded at the current platinum bar price.

The Platinum Eagle

© gchapel - stock.adobe.com

The American Platinum Eagle is a US bullion coin which is even accepted as official currency in the US at its face value. However, hardly any Americans would attempt to use the eagle as a means of payment because this platinum coin is valued at well above its nominal face value.

Platinum Eagle coins are available in the following versions:

• 1/10 ounce coin at $10 face value

• 1/2 ounce coin at $25 face value

• 1/2 ounce coin at $50 face value

• 1 ounce coin at $100 face value

The design features a Statue of Liberty on the front, while the reverse carries an eagle motif which changes every year. Coin collectors can also purchase the Platinum Eagle minted as a “polished plate”.

The Platinum Maple Leaf

The Maple Leaf is the most popular investor and collector coin after the South African Krugerrand. It is available in gold, silver and palladium as well as platinum, and has been available since 1997 in weights between 1/20 ounce and 1 ounce. In Canada, where the Maple Leaf is minted, coins with face values between 1 and 50 Canadian dollars also have the status of legal tender. These coins also carry a portrait of Queen Elizabeth II of England on the front, while the back features a maple leaf, which is the national symbol of Canada.

Platinum coins as an investment

If you want to invest in platinum as a precious metal, you can opt for either bars or coins. The buyer’s premium for platinum coins is a little higher, but in addition to their pure metal value, the attractive motifs mean the character of such coins will always have a strong appeal for collectors. In addition, collectors’ items which are particularly in demand can achieve a greater increase in value than an investment in platinum bars.

Compared to gold and silver coins, the market still considers platinum coinage to be a somewhat exotic investment choice. However, the demand and with it the selection of coins has significantly increased in recent years. Some of these are described in the text above, and investment grade coins are mostly offered as minted coins which have been uncirculated. However, coins available as proofs are likely to command a further premium because of their higher degree of scarcity.

A high value density, together with a high liquidity – thanks to a strong demand for platinum as an industrial metal – gives a platinum investment some clear advantages. However, platinum’s liquidity is less than that of gold, which leads to larger market spreads for platinum.

Taxation of platinum coins

Unlike gold purchases, VAT must be paid at the current rate when buying platinum. VAT in Switzerland is 8.1 percent, while the comparable rate in Germany is 19 percent. This cost factor should always be taken into account when planning any investment.

Tip: A legal option which completely avoids payment of the VAT on platinum is a bonded warehouse or open bonded warehouse in Switzerland, such as the facilities offered by Swiss Gold Safe.

Investment coins and collector coins

Investment coins, which are also known as bullion coins, are usually produced in larger quantities for the purpose of direct investment in a precious metal. Their weight and fineness are precisely specified: The standard is the 1 oz unit, which corresponds to around 31.1 grams, with a fineness of 999.5 thousandths. Upon purchase of such a coin, you acquire 31.1 grams of pure platinum, and such investment coins are particularly suitable for beginners. Larger denominations are also available. However, note that although smaller denominations are comparatively more expensive to buy, they are also much easier to sell.

In addition to investment coins, there are also collector coins made of platinum. Though these coins clearly also have some value as investment coins too, over time it is the market which ultimately decides which coins will become the most popular and collectable, and thus of the greatest monetary value.

What are platinum coins worth?

The world market price for platinum (the spot price) also significantly influences and determines the price of investment coins. However, a small trading surcharge, known as a premium, is also added, and transactions are also subject to VAT (see above). Particularly collectable coins are also priced higher because they are perceived to have an innately higher value.

Storage of platinum coins

Platinum coins can either be stored at home, in a bank, or in a bank-independent safe, such as those offered by Swiss Gold Safe.

Please see our article on platinum for more information about platinum as a precious metal.

Information about platinum coins at a glance:

- In the past, platinum coins were only circulated as common currency in Russia.

- Today platinum coins are only used as investments or treated as collector coins.

- Platinum is much in demand as a precious metal used in industrial production, which also means price increases can be expected in the future.

- The value of platinum coins is essentially determined by the market spot price for this precious metal.

- Platinum coins are a good investment product thanks to their high value density and good liquidity.

- Storage in a duty-free warehouse can legally avoid payment of VAT.