Store cash – protect private assets and avoid negative interest rates

Additional information > Services, clients and facilities > Store cash – protect private assets and avoid negative interest rates

- This article informs you about cash deposits made as a private customer. If you represent a company, then switch to the article about cash storage as an institutional client.

Avoid deposit and penalty interest fees with cash storage

Since the first means of cash payments were introduced, people have hoarded their capital for harder times. Back then, coins and bars were packed in boxes or sacks and stowed in a hiding place. With the introduction of the first paper money in China around 1000 AD, wealth became much more portable and could be accommodated more easily. Its physical importance eventually declined further with the beginning of the first banking business in 15th century Italy. Today, the majority of banks around the world manage assets in a new way – digitally. Cashless payments and online banking have become the standard way to make international payments over the course of the last couple of decades. There are also even more modern payment methods, such as cryptocurrencies.

Only a small proportion of the wealth held in bank accounts is available in the form of cash. Take Switzerland, as an example, which had banknotes totaling in the region of 80 billion Swiss francs in mid-2019. With 8.5 million inhabitants in the country, this would amount to just under CHF 9,500 per person. In the case of a nationwide run on the banks, it can therefore be reasonably assumed that the majority of Swiss account holders would not receive their balances in cash.

© swisshippo - stock.adobe.com

Swiss franc storage to avert the negative interest rates of central banks

The potential for a run is why private banking customers should think about securing their assets in a timely manner. Another important point is the negative interest that is charged on account balances. Many banks are already charging negative interest in the form of deposit fees. Saving large sums of money on an account does not offer a return but causes costs through such penalty interest fees. In addition, one assumes counterparty risk up to the amount of the respective deposit insurance when depositing at a bank if bankruptcy were to occur.

An alternative to this is the secure storage of physical banknotes, so why not do so? Many people hoard cash at home in a supposedly safe hiding place. However, a domestic safe is only conditionally suitable for cash because, should burglars break into the house, the theft must be proven. In addition, home contents insurance usually provides only a few thousand francs as coverage and special supplementary insurances for higher monetary values are associated with more expensive premiums.

Even a classic bank deposit box can prove to be tricky. Although the stored monetary value would still be available to you without losses, even following a bankruptcy, insurance is not straightforward here either. Unlike a classic bank account, however, there is no counterparty risk.

Keep money in bank-independent storage facilities

Quite another approach would be the use of bank-independent storage facilities in Switzerland or Liechtenstein. A safe deposit box in a private, high-security facility is unaffected by potential banking system failures and bankruptcy – plus your deposit remains accessible at all times. The storage of cash is carried out with discretion, with complete security and, in Switzerland, without any requirement for legal reporting. Furthermore, it is possible to take out appropriate insurance for the contents of your deposit box with ease. In addition, the assets remain the property of the customer because, in the end, the stored cash never forms part of the balance sheet of the storage provider according to the Swiss Code of Obligations. This rule protects clients’ assets in the unlikely event of bankruptcy.

- Find out more about non-banking system safe deposit storage in Switzerland or in the Principality of Liechtenstein.

Free consultation or questions? Contact us

How big does a safe deposit box have to be and how much does cash weigh?

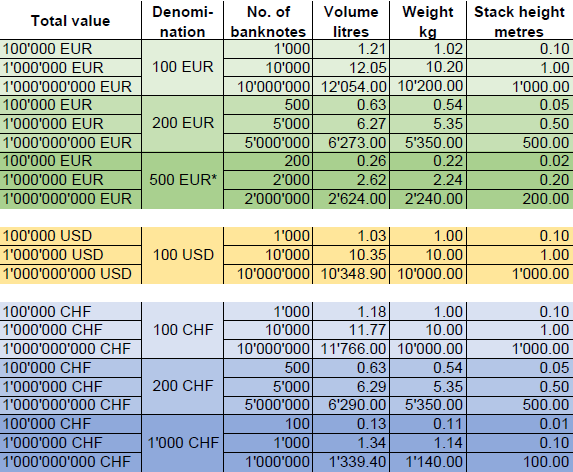

Depending on how high your cash volume is and in which denomination it is, you need lockers of various sizes or locker compartments. This also affects transportation to a high-security warehouse if you want to store Euros or US dollars. In this regard, Swiss customers have the advantage of the CHF 1’000 banknotes which are the second most valuable notes in the world. A bundle of one hundred of these notes has a value of CHF 100,000 and weighs just 114 grams. At a height of just one centimetre, a single stack of them can easily store thousands of notes, something that can be transported easily. This advantage is particularly helpful when institutional clients are storing millions or billions of Swiss francs.

The situation is quite different with Euros and US dollars. The biggest banknote of the European Union (EU) is currently the 200 Euro bill and with the US dollar, it is only a 100 dollar note. The transportation of 100,000 in these respective monetary values becomes more complicated with these denominations. Logistical problems can become even worse with larger sums like a million or a billion. Depending on the nominal value, transport vehicles may be required.

We have summarised an overview of the weight and volume of physical banknotes for you, below. The benchmark figures are 100 thousand, 1 million and 1 billion. The overview refers to the most valuable banknotes in the EU, Switzerland and the USA. The measurements and weights are based on the current values of the European Central Bank (ECB), the Swiss National Bank (SNB) and the US Federal Reserve.

* This banknote has not been printed since the end of 2014, but it remains an official form of legal tender.

Contact information about cash storage

Do you want to store cash and have further questions? If so, then our specialist cash storage team will be happy to help you. You can contact us at any time.

Summary

- Banks’ cash reserves are scarce. The entire amount in Switzerland is not at all sufficient for the complete payment of the country’s existing account balances.

- Account balances above a certain threshold are now subject to negative interest charges.

- Storing cash securely at Swiss Gold Safe is a viable alternative.

- There is no counterparty risk when storing money, something that is not the case with banks beyond the deposit guarantee amount.

- Bank-independent storage facilities in Switzerland and Liechtenstein are always accessible. The stored cash always remains the property of the customer.

- In terms of cash storage, Swiss customers have an advantage due to the high denominations of banknotes. This is not the case when storing Euros or dollars which require more physical space.