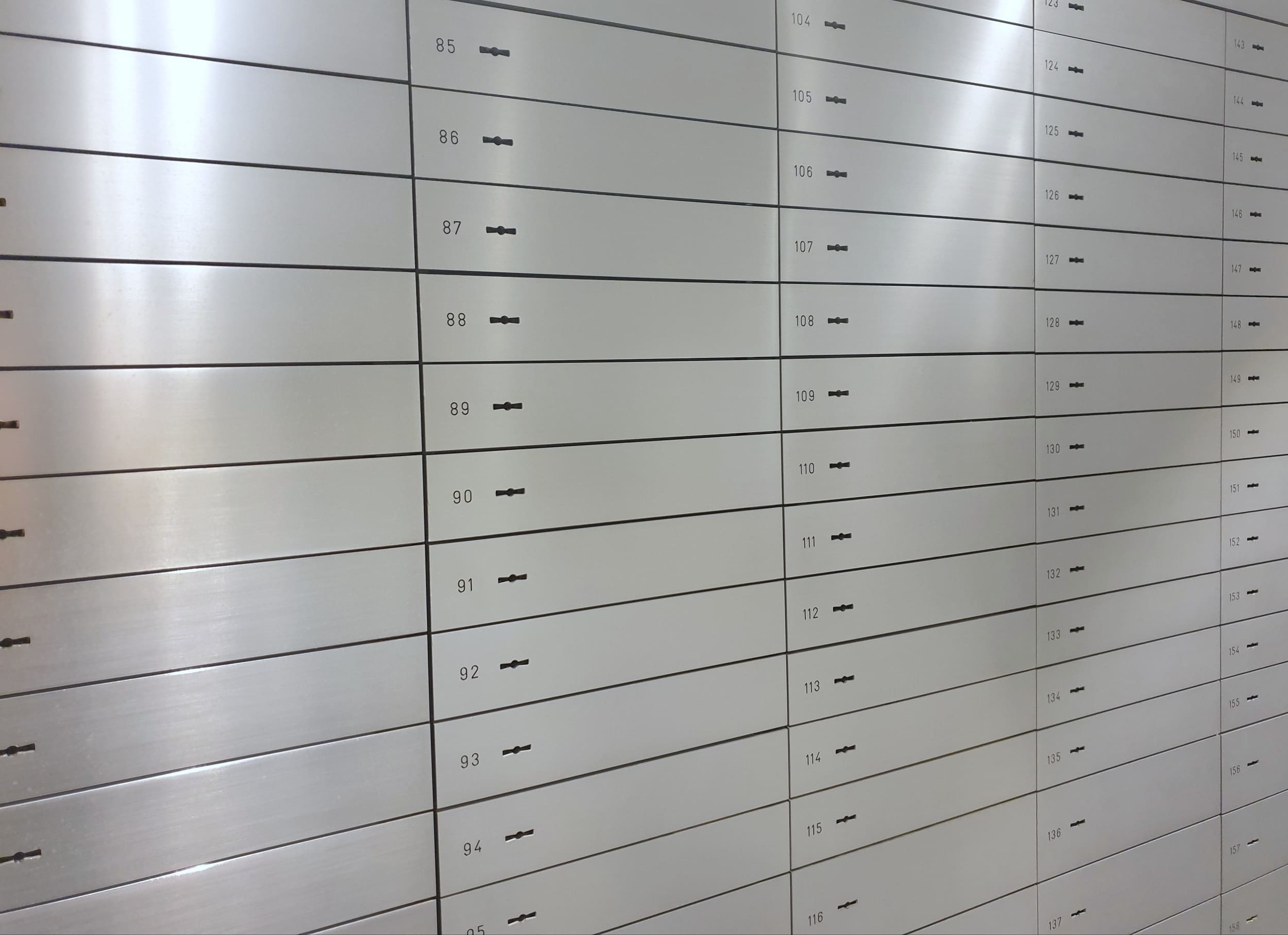

A private safe deposit box for documents

Additional information > Services, clients and facilities > A private safe deposit box for documents: Secure and discreet

Switzerland and Liechtenstein offer all these benefits

Safe deposit boxes are a secure storage solution not only for assets, such as gold bars or jewellery, but also for the secure storage of all kinds of documents: wills, contracts, valuable letters and similar original items. A safe deposit box for documents is protected by modern security with insured contents and affords you maximum discretion. But are these preferred features still available today? And what about secure safekeeping at home or at your local bank?

For those seeking secure storage, the criteria for choosing a safe deposit box provider will be the crucial issue. According to your requirements, the list might include convenient access, physical security, protection of your individual property rights, storage capacity and flexible payment options. Anyone looking for a blend of all these advantages will find this effectively rules out both home safes and bank safe deposit boxes. However, privately run safe deposit systems in Switzerland or Liechtenstein are an ideal solution. Both these independent nations can offer domestic and international customers a comprehensive and secure document storage option with quality service.

© Gina Sanders - stock.adobe.com

Why home safes are generally inadequate for document storage

Many important documents are often kept in your own home, and for obvious reasons: Your documents are within easy reach for when they are needed – even if, as an owner, you may soon forget they are even there. However, depending on the value and importance of such documents, secure storage may be a practical necessity. Typical wall- or furniture-type home safes tend to offer just a false sense of security. Burglars usually have an easy time with such arrangements because, according to its design, a home safe offers little resistance, or else will simply be ripped from its anchorage and carried away.

Another argument against storing documents at home is the occurrence of unforeseen hazards such as fire, floods, earthquakes or similar natural disasters. European weather phenomena in recent years suggests those affected by such emergencies often have literally just a few minutes to save themselves. That means there is generally little time to retrieve the contents of a home safe when the occupants must swiftly evacuate the property. Likewise, there may be no insurance available to cover loss or damage due to natural causes. And replacing your destroyed documents – even where this is a feasible option – can be both costly and time-consuming.

Bank safe deposit boxes: issues to consider for important original documents

For many with important documents, a bank safe deposit box would seem a practical alternative to a home safe. The primary advantage is that the documents remain geographically close to their place of residence. But to secure this benefit, you must first find a bank still prepared to offer its customers safe deposit box facilities. Banks now regard safe deposit rentals as an expensive sideline, not least because their own security facilities are becoming outdated and much in need of costly modernisation. In addition, many bank branches in rural areas are now closing down, which means the number of safe deposit boxes actually available to customers is rapidly decreasing.

Furthermore, the attractiveness of bank safe deposit boxes has also decreased significantly. This is because, in order to open a safe deposit box for document storage, a prospective customer is required to set up a bank account to pay the regular rental fees. Here it is important to realise that, to prevent money laundering, banks are obliged to record customer account data, including safe deposit box numbers, and make this information available to the authorities. However, within Europe, Switzerland itself is exempt from this regulation. Elsewhere in the European Union (EU), and the European Economic Area (EEA) – which includes Liechtenstein, but not Switzerland – you will hear references to an official “safe deposit box register”. In these jurisdictions, this effectively means that discretion and privacy will apply only to the actual contents of your safe deposit box.

Beyond this, customers have come to realise that bank insolvencies and similar events are a real possibility these days. And during any bankruptcy settlement procedure there is often no access to your safe deposit box for a very long time. So, for this reason alone, it may be prudent to consider viable alternatives to a bank safe deposit box.

© Swiss Gold Safe AG

Private safe deposit boxes outside the EU as an alternative option

The impact of financial regulations coupled with the contraction of banking facilities means that true discretion in the management of safe deposit boxes for documents is now only available from private providers. Companies such as Swiss Gold Safe specialise in the storage of valuables. And because they provide a storage-only service, such businesses can operate completely independently of the banking system, and thus are not subject to any reporting obligations, nor are they required to contribute to any central data registers. Furthermore, as a privately run service provider, Swiss Gold Safe maintains modern, high-security facilities and can offer international clients bank-independent safe deposit boxes in Switzerland and bank-independent safe deposit boxes in Liechtenstein.

Switzerland and the Principality of Liechtenstein are renowned worldwide for their unconditional support for individual property rights, a concept deeply rooted in the history and culture of both nations. In addition, each of these independent states has a stable economy, making them ideal storage locations for the protection of a whole variety of valuable assets. Their shared currency, the strong Swiss franc, plays an influential role and many rely on its economic reputation to create a hedge against inflationary pressures elsewhere.

Safe deposit boxes for documents: physical security

Private security companies naturally focus on the physical security of their safe deposit box systems. But this goes much further than simply installing advanced burglary protection to combat the increasingly bold methods employed by professional criminals. In the context of electronic control and digital surveillance systems, modern security systems have to address much broader concerns. These include, for example, emergency power supplies ready to intervene in the event of a power shortage or electricity supply failure.

Swiss Gold Safe safe deposit box systems go one step further than this and offer clients air-conditioned vaults that can maintain the optimal temperatures and climatic conditions for stored documents and assets.

- You can find out everything about different safe deposit box concepts in our summary and overview of safe deposit boxes.

Safe deposit box insurance for documents

Even the best security precautions can only achieve so much in the event of unforeseen events. That’s why our special safe deposit box insurance is designed to protect clients against the total loss of their secured assets. Swiss Gold Safe’s basic insurance is included in the safe deposit box rental and can be extended as required to provide a comprehensive insurance covering the actual value of your stored contents. With a sum insured covering the replacement of stolen or destroyed assets, theft risks, fire damage and losses due to natural disasters will no longer be a major problem.

Important facts about safe deposit boxes for documents

- Safe deposit boxes are ideal for storing important documents of all kinds. Your own priorities will define the critical selection criteria.

- Home safes lack reliable burglary protection, and thus only offer protection against opportunist theft.

- Those who value privacy and discretion have to accept bank safe deposit box restrictions and banking’s current financial reporting obligations. In addition, security arrangements are are often outdated, while a bank insolvency could also deny you access for a significant period.

- Private storage companies offer an alternative to bank safe deposit boxes. There is maximum discretion with no financial reporting requirements.

- Swiss Gold Safe operates bank-independent safe deposit boxes for documents and other assets in Switzerland and Liechtenstein.

- Their safe deposit boxes offer modern security and provide ideal climatic conditions. Safe deposit box insurance is automatically included as part of the service.