A safe deposit box abroad has many advantages

Additional information > Services, clients and facilities > Storing gold in a safe deposit box in a secure jurisdiction

Store your assets in Switzerland or Liechtenstein

Physical precious metals, jewellery or crypto wallets can represent considerable wealth, especially gold coins or bars. Such valuables are commonly used as a hedge against inflation, or to diversify an investment portfolio primarily comprising stocks and real estate. But risk diversification can also be applied to the storage location of your assets. A bank-independent safe deposit box in Switzerland or Liechtenstein, for example, is ideal.

© luzitanija - stock.adobe.com

To completely understand the benefits, it’s very helpful to consider in detail just what “bank-independent” really means. For a very long time, bank safe deposit boxes really were the default option for private individuals and entrepreneurs wishing to store valuables. After all, such safe deposit boxes offered a high level of physical security – protection of a very different order to what could otherwise be achieved via a secret hiding place, or even a wall safe, somewhere within your own four walls. But nothing is as predictable as change itself, which certainly applies to bank safe deposit facilities. Today, these security systems are so often found to be outdated because financial institutions now tend to focus their attention elsewhere.

Meanwhile, the anonymity of bank safe deposit boxes has also decreased thanks to the unintended consequences of tighter financial regulations: If you want to open a safe deposit box at your local bank, you will almost certainly need a bank account to facilitate collection of the rental fees. Consequently, your customer data – including your safe deposit box number – will be automatically recorded in a central, government database. Should there be any suspicion of illicit activity, the government authorities can gain immediate access to your data. This central database is often referred to as the “safe deposit box register”.

Are you looking for a safe deposit box in another jurisdiction? Then why not contact us:

This particular measure is actually designed to curb international money laundering and the financing of terrorist activities. However, private safe deposit providers are not affected by this regulation. This means such independent safe deposit box facilities, like those currently available in Switzerland or the Principality of Liechtenstein, have many advantages over traditional bank safes. These benefits include maintaining your privacy, observing absolute professional discretion, and maintaining the utmost level of anonymity.

Storing gold in a safe deposit box in another jurisdiction

Many people consider gold products a really viable alternative to other investments. This is hardly surprising, given that this valuable precious metal has been in use as a medium of exchange for thousands of years. Even after it was effectively replaced by paper money, gold still maintained its unique psychological attributes. Gold remains a highly valued commodity, especially in times of crisis, which explains why gold bars and coins are still in great demand. Bullion gold is thus synonymous with financial security, simply because it is accepted as the equivalent of a hard currency and traded all over the world. Between 2014 and 2024, the market price of gold – whether quoted in Swiss francs, US dollars or euros – has more than doubled.

Because of its high material value, gold assets obviously require protected storage. Privately managed safe deposit boxes in secure international jurisdictions which remain independent of the banking system are ideal for this purpose. Swiss Gold Safe is a specialist provider offering private individuals and commercial clients safe deposit box facilities in Switzerland or the Principality of Liechtenstein. These state-of-the-art security facilities are suitable for storing all precious metals, jewellery, cash, important documents and many other assets. Safe deposit contents will always remain the client’s personal property; so the provider is not obliged to report any details to the authorities. Privacy and absolute discretion are paramount.

© Swiss Gold Safe AG

Switzerland and Liechtenstein share a unique, historical commitment to the unconditional protection of property rights – a commitment unparalleled anywhere else in the world. This forthright understanding is extended not only to the citizens of each state, but also to business clients and international guests alike. These twin democracies each have a high global reputation, and both enjoy economic and political stability, underpinned by the support of an independent currency: the ultra-robust Swiss franc. And thanks to the presence of most of the world’s leading gold refineries, Switzerland itself is also considered an important centre for the precious metal trade. These are just some of the many good reasons for storing gold in a safe deposit box in a secure international jurisdiction.

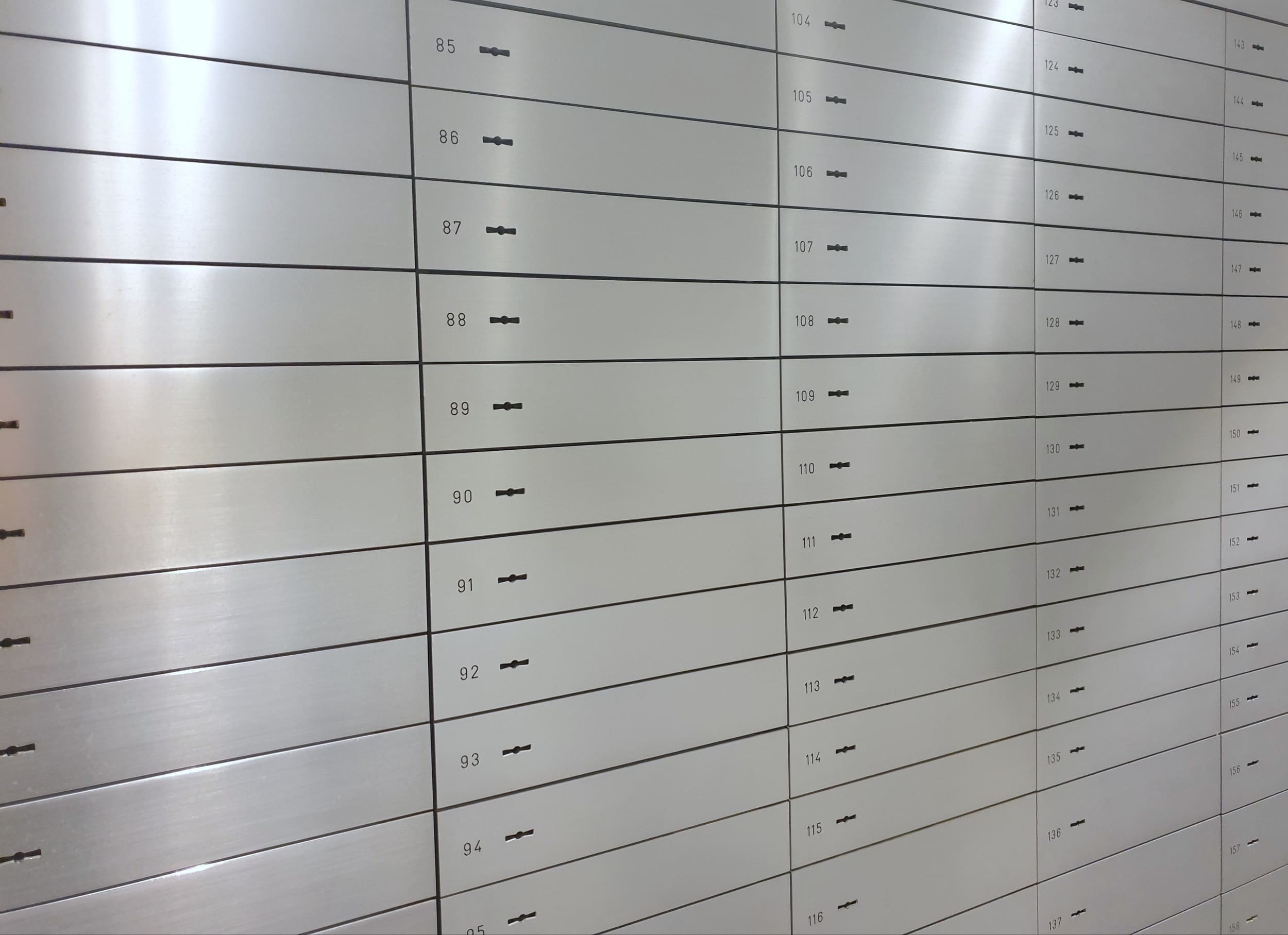

Bank-independent safe deposit boxes abroad

Swiss Gold Safe’s modern high-security facilities are located in Switzerland and Liechtenstein. Both countries lie in the very heart of Europe and, thanks to their excellent transport links, can be easily reached by car or public transport. Prospective clients can then choose between a bank-independent safe deposit box in Switzerland, or a bank-independent safe deposit box in Liechtenstein. A range of different sizes are available, which means our facilities can always be adapted to your precise content needs. And thanks to our integrated basic insurance, your stored valuables will always be protected. Comprehensive risk insurance can also be arranged to provide complete protection up to the full value of your stored assets. Our safe deposit boxes remain entirely anonymous: In addition to discreet processing, we offer a range of different payment methods, and no bank account is required to open your personal safe deposit facility or settle the annual rental fees.

- Segregated storage in our domestic warehouse in Switzerland is strongly recommended for larger gold holdings. Swiss Gold Safe also offers allocated & segregated storage of gold bars and gold coins for international clients.

Import and export of precious metals to and from other jurisdictions

Special regulations apply to the export of precious metals or cash when crossing national borders. Apart from any allowances permitted by law, travellers must otherwise declare the value of such goods at the customs export office. So, for instance, if you wish to travel with popular gold coins such as the Krugerrand, Vienna Philharmonic, Maple Leaf or Australian Kangaroo, you should always check with the relevant customs office to determine the extent of applicable regulations. Each exporting country invariably has its own (different) legal regulations. To take just one example: Germany has a cash import/export limit of 10,000 euros (or an equivalent value). This same restriction also applies to bullion coins and bars made from gold, silver, platinum or palladium. As above, travellers are always recommended to contact the respective customs office for further advice.

Are you looking for a safe deposit box in another jurisdiction? Then why not contact us:

The import of precious metals into Switzerland and the Principality of Liechtenstein is also subject to customs legislation. While investment gold can be imported without VAT, products made from silver, platinum or palladium are still subject to a statutory VAT levy. The Federal Office for Customs and Border Security (FOCBS) can provide information about goods which can be imported into Switzerland or Liechtenstein, and can also explain any special conditions which may apply.

An alternative approach: Purchase your gold direct in Switzerland or Liechtenstein

If you wish to avoid having to handle such customs formalities, there is a convenient alternative: You can also purchase gold products or white metals directly from local specialist retailers in Switzerland or Liechtenstein. Safe deposit clients can also purchase precious metals abroad – even anonymously if they prefer. Precious metals can be purchased over the counter in both Switzerland and Liechtenstein up to a value of 15,000 Swiss francs. For comparison, it’s worth noting that the equivalent cash-purchase limits elsewhere can be as little as 2,000 euros – at today’s gold prices, that’s not even enough to purchase a Krugerrand coin weighing just one troy ounce.

© vladk213 - stock.adobe.com

Other international jurisdictions can also be attractive for the purchase of white metal investment products, and bullion coins and bars made from silver, platinum and palladium can be purchased VAT-free – provided they are immediately stored in a duty-free warehouse in Switzerland. Swiss Gold Safe also offers segregated duty-free storage of investment silver.

Take advantage of the partnership between Swiss Gold Safe and Echtgeld

Many of today’s international clients prefer a comprehensive, one-stop service for their precious metals which still offers complete freedom in terms of purchase and storage options. Swiss Gold Safe has worked in partnership with the Swiss precious metals retailer Echtgeld AG over many years. Clients can thus purchase gold or silver and also receive expert advice. And upon request, this specialist dealer will also deliver your precious metals purchase direct to our Swiss Gold Safe safe-deposit facility. For the client, this convenient arrangement also avoids the additional responsibility of organising the transport of valuables. Furthermore, selling inventory can also be done just as easily. Whilst remaining completely independent, both companies collaborate to provide an optimal complementary service. Clients can thus continue to benefit from the individual core competencies of both specialist providers.

Summary: A safe deposit box in another jurisdiction

- Physical gold bars and coins are considered a valuable hedge against inflation, or can be used alongside other investments as part of an asset diversification strategy.

- To minimise risk, assets can also be stored at alternative locations. Safe deposit boxes in Switzerland or Liechtenstein are particularly suitable for this purpose.

- Both these alternative jurisdictions are independent democracies with a strong historical tradition of protecting individual property – a unique advantage extended to both citizens and international clients.

- The private specialist provider Swiss Gold Safe offers bank-independent safe deposit box facilities in both countries.

- Special regulations apply when importing and exporting precious metals. The respective customs offices should always be consulted to provide further relevant information.

- As a convenient alternative, bullion gold can also be purchased direct in Switzerland or Liechtenstein. Precious metal dealers such as Echtgeld AG can organise the onward transport of purchases to a Swiss Gold Safe safe-deposit facility.