The alternative to individual custody of gold and silver

Additional information > Prevailing conditions for value storage in Switzerland and Liechtenstein > Gold securities: an individual custody alternative

Bank-independent storage of precious metals in Switzerland with OrSuisse negotiable warehouse receipts

Precious metal storage arrangements should be carefully planned, because the market provides private and commercial investors with various storage options designed to meet different requirements. But is there any kind of storage which renders precious metals more flexible than classic safe deposits or individual custody? Yes indeed: Internationally tradable, so called negotiable warehouse receipts issued by OrSuisse Ltd in Switzerland.

This long-established partner business of storage specialist Swiss Gold Safe can issue storage receipts for precious-metal bullion bars or coins, which can then be used just like any fully tradable securities. Commonly known as negotiable warehouse receipts, these documents issued by OrSuisse according to the Swiss Code of Obligations and facilitate the transfer of holdings via a simple endorsement. As a result, investment holdings can easily be sold or used as a security without any physical movement of the described goods. The associated gold coins, or gold bars, are stored under high-security individual custody arrangements. In the case of investment holdings in silver, platinum or palladium, segregated storage usually takes place in a duty-free warehouse in Switzerland – because any subsequent transfers are then VAT-free. Thus, bank-independent storage of precious metals in Switzerland also increases the fungibility and liquidity of your investments. Because negotiable warehouse receipts can be used to secure and guarantee any transfer of your recorded gold and silver investments.

Learn more about OrSuisse

Independent storage company OrSuisse was established in 2012 and has extensive expertise as well as many years’ experience in the high-security storage of precious metals. This privately-run Swiss company focuses on an innovative new storage concept for capital investments in gold, silver, platinum and palladium. Thanks to OrSuisse negotiable warehouse receipts, investors from all over the world can personally manage their own physical precious metal portfolio.

OrSuisse maintains highly secure vault systems for the storage of precious metals at Swiss Gold Safe. These holdings are secured under segregated individual custody arrangements in Switzerland. All stored goods are insured and subject to rigorous ongoing controls. However, OrSuisse does not trade in precious metals or warehouse receipts, and thus acts purely as a storage company in an entirely neutral capacity. Consequently, the company is subject to no reporting obligations, allowing them to maintain the strictest privacy and act with the utmost discretion – as would be expected of a premier Swiss institution.

OrSuisse: Advantages for investors

OrSuisse can store precious metals such as bullion bars and coins outside the banking system. The storage format offered is individual custody, which means your original goods will always remain your property. Individual custody offers you many advantages over collective custody. For instance, when you retrieve your stored holding, the self-same pieces will then be returned to you. This can be verified by checking your return against the bar and seal numbers recorded on your negotiable warehouse receipts. In addition, your goods are fully insured when stored in the company’s high-security warehouses. Storage fees can be paid via bank transfer, by bank-independent transactions in different currencies, as well as with cash or cryptocurrencies.

Gold and white-metal investments can, of course, be stored in an OrSuisse domestic warehouse. However, the purchase or sale of silver, platinum and palladium investment products is subject to VAT. It is therefore much more advantageous to store these white and grey metals in a Swiss bonded warehouse (with no minimum storage fee), because investors can then save on paying a VAT levy. VAT only becomes due when bars or coins actually leave the warehouse for onward delivery. Clients receive negotiable warehouse receipts for all the precious metals they deposit – regardless of whether these are held in a domestic or duty-free warehouse. And thanks to the Swiss Code of Obligations, these documents have official status as securities which means you can use them as a legal instrument to trade your holdings internationally.

What’s so special about negotiable warehouse receipts?

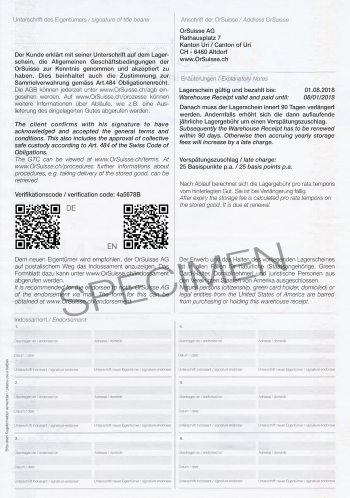

OrSuisse’s counterfeit-proof negotiable warehouse receipts are designed to allow up to ten identical products of the same denomination and metal to be recorded on each document. For instance, a receipt could list ten 100-gram gold bars each with their own unique serial numbers. Alternatively, a warehouse receipt could be issued for a maximum of ten gold or silver one-ounce coins of one particular type: Krugerrand, Maple Leaf, Vienna Philharmonic etc. Such coins are generally packed in sealed coin tubes bearing a seal number.

Tradable warehouse receipts are tied to the goods they describe, which means precious metals cannot be removed without the accompanying security instrument. At the same time, this receipt document also guarantees the release of such goods. However, a negotiable warehouse receipt (and thereby the registered precious metals it identifies) can also be resold without any physical movement of goods having taken place. Each receipt has endorsement fields on the reverse which can be completed to facilitate this purpose.

Who could benefit from using OrSuisse warehouse receipts?

OrSuisse clients include the type of investors who are primarily interested in the long-term storage of precious metals. This includes not only Swiss investors, but also those from many other European countries, and indeed investors worldwide. They particularly appreciate the benefits of tradable warehouse receipts, because such documents combine the flexibility of securities with the unique aspects of physical precious metals. As well as accommodating investors in gold, warehouse receipts also provide an attractive VAT-free option for those with white metal holdings. Here, unlike standard storage arrangements, there is no minimum storage fee for white metals stored in a bonded warehouse. This option also appeals to clients planning to spend smaller budget amounts on silver investments.

Overview: The alternative security for individual custody

- In addition to the classic safe deposit or individual custody, there is also the option of storing your precious metals in Switzerland using internationally negotiable warehouse receipts, which have the status of securities.

- Our partner company OrSuisse has developed a bank-independent storage concept, which now allows precious metal holdings to be traded more flexibly.

- OrSuisse negotiable warehouse receipts can be sold or used as security without your precious metals ever having to leave the warehouse.

- This type of storage is suitable for gold investments. In addition, white-metal investment products such as silver, platinum and palladium can also be stored VAT-free in duty-free warehouses with no minimum storage fee.

- All goods are exclusively stored under individual custody arrangements where they are segregated and fully insured. Unlike collective custody arrangements, the self-same original goods are always returned to the client.

- Swiss domestic and duty-free warehouses use highly secure vault systems.