The precious metal account: A simple way to buy and sell gold or silver

Additional information > Investment forms for gold, silver, platinum and palladium > Precious metal accounts: Gold & silver investors

An investment solution for short and medium-term capital investment

Those wishing to invest in precious metals without responsibility for storage can open a precious metals account – indeed various banks offer investors such facilities. When a sale transaction takes place, this often involves the delivery of actual gold or silver. This arrangement has advantages and disadvantages, and is not always suitable for every investor. One alternative is the segregated storage of bars or coins with a specialist provider.

A precious metal account operates much like a bank account: Users can deposit money in their metal account at any time, and thus purchase and accumulate gold, silver, platinum or palladium. And when required, precious metals can also be sold again in the same way. Transactions are based on the current price of each respective metal. So, unlike the classic sale or purchase of bars and coins, this investment model lends itself to a short to medium-term investment strategy.

© vladk213 - stock.adobe.com

Background information about Swiss precious metals accounts

In principle, a precious metal account is set up in a similar way to a classic private- or savings account into which monies are paid. However, in this scenario, funds are allocated not as cash amounts but as precious metal shares. As a result, gold investors, for example, receive no interest on credit balances. Also, because such metal accounts are only used for bookkeeping and for tracking claims arising from precious metal trading, any account deposits made with Swiss banks are rarely backed by physical gold or silver bullion bars. Ownership of physical precious metals is only acquired once a delivery is implemented, provided this is contractual requirement.

The unique aspect of trading via precious metal accounts is that such buying and selling is always VAT-exempt – because it involves only ‘virtual’ metal. Although trading in physical investment gold is VAT-free in any circumstances, the same does not apply to palladium, platinum and silver. These white and grey metals are generally taxed at the statutory VAT rate over the counter and in online trading. In Switzerland, this rate will be 8.1% as from January 2024. For this reason, these investment products are often deposited in a Swiss duty-free warehouse where transactions are free of VAT.

Bullion account holders have no need to arrange their gold or silver purchases in full bars. Because, strictly speaking, they only purchase precious metal shares, these can be for any amount their investable budget allows. Purchase units in ounces or grams are common, but a minimum transaction fee is often required. Investors receive an account credit for their purchases, and whenever a sale occurs, its value is then deducted from their precious metal credit balance.

In practice, whenever a sale takes place, account holders can often choose between receiving a payout or delivery of actual amount of the precious metal involved. However, this will primarily depend upon the options available under each respective contract. This often states under what circumstances, and in what denominations, a release of bullion can take place. Depending on the terms of the agreement, a conversion into coins may also be possible, but this option usually attracts higher fees: As well as high premiums, the considerable economic advantage of trading a particular quantity in bars is also lost.

Precious metal accounts are mainly available through Swiss banks and banking institutions in other European countries.

A bank precious metals account

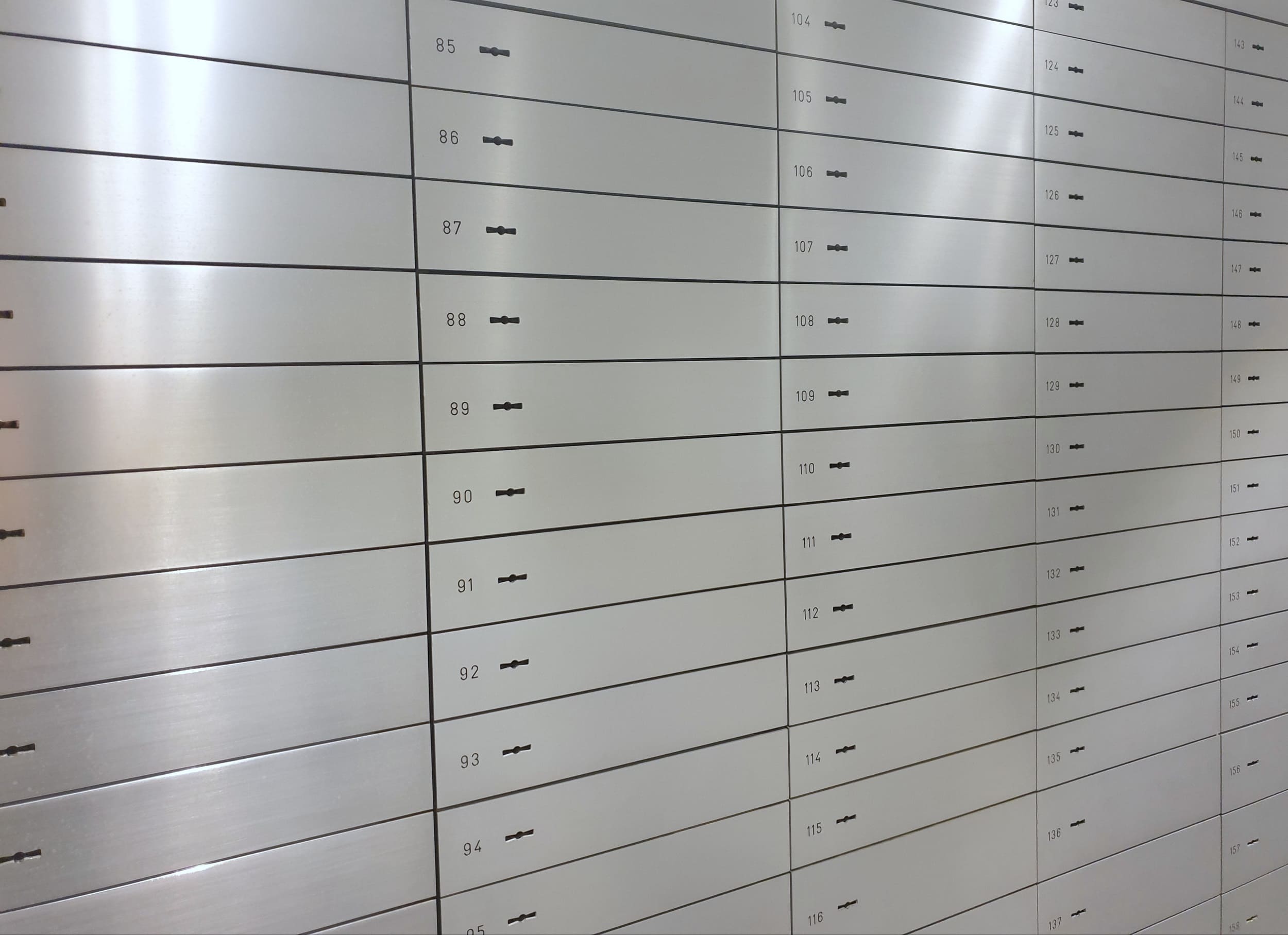

Precious metal accounts are now offered by many banks as a feature of their investment business. Thus, investors can open a gold or silver account rather like setting up a savings account. However, this arrangement also requires a bank account from which you can transfer funds to your precious metal account. Generally, you have to stipulate your choice of precious metal. So if you wish to invest in gold, silver and platinum at the same time, you will need separate accounts. Because of security concerns, at the present time, only a handful of banks offer convenient online management of a precious metal account. So instructions to buy or sell must generally be placed by telephone, or arranged via a branch office. In addition, many banks also charge account management fees on precious metal accounts. So, dependent upon the quantities involved, a classic safe deposit box could be a cheaper alternative for physical precious metals.

© Swiss Gold Safe AG

Unlike bank savings accounts, balances in Swiss precious metal accounts are not usually covered by deposit guarantees, unless a contractual repayment in a fiat currency has been agreed.

- IMPORTANT: It is also worth knowing that precious metal accounts represent a recoverable debt of the bank. So if the financial institution becomes insolvent, these precious metal holdings will be considered part of the bankruptcy estate. Subject to the terms of the contract, investors may only receive compensation equivalent to the amount available under any applicable deposit protection scheme.

Advantages of a precious metals account

For investors, the biggest advantage of a precious metal account is the extremely convenient storage arrangements. Investor account holders never have to worry about safe storage of their precious metal bars. This in turn means they also have no transport or shipping costs to pay. Furthermore, unlike the purchase of precious metal derivatives, most Swiss banks do not charge brokerage fees on their precious metal accounts. And when considering a precious metal account against an ETF option, a gold account is particularly advantageous.

Beyond this, precious metal accounts also offer high liquidity: Credit balances can be easily increased or resold at any time without long delays. This also applies with the lower trading margins (spreads) as compared to physical precious metals. So, dependent upon the scale of the respective precious metals account, the annual fees can be lower than the equivalent safe deposit box maintenance fees.

Disadvantages of a precious metal account

Unlike a classic savings or fixed-term deposit account, a precious metal account will not pay any interest on the gold or silver share balances you accumulate. Additional income can only be acquired if you are able to sell your precious metal shares when market prices are favourable. Furthermore, you do not own any physical precious metal – you can only acquire the right to delivery of precious metal if you sell your shares in order to do so.

Like classic private accounts, precious metal accounts are also subject to the international Automatic Exchange of Information (CRS) agreement. This means banks are obliged to exchange information about financial accounts with other countries, a measure designed to curb tax evasion and money laundering. Furthermore, holdings in precious metal accounts must be declared on a Swiss tax return. And whenever physical investment products such as silver, platinum and palladium are delivered, they are subject to statutory VAT which must be paid in addition to the delivery fee.

Furthermore the counterparty risk is to be evaluated. The precious metals account is a debt of the bank and thus part of the bankruptcy estate in the case of a bank failure.

Who is a precious metal account suitable for?

Precious metal accounts can be used by private investors and commercial institutions alike. They are suitable for both medium and long-term investments. A gold account is particularly suitable for investors who wish to invest in precious metals but would prefer to avoid handling the attendant modalities. The arrangement would also suit investors planning to regularly deposit fixed or variable amounts in order to build up their portfolio. Experts don’t advise those who already own precious metals to open an additional metal account, because it’s not usually possible to merge these different acquisitions, or doing so would involve significant losses.

© ChaotiC_PhotographY - stock.adobe.com

For larger precious metal volumes, a safe or safe deposit box facility may prove a cheaper option than a precious metal account. This is mainly due to the fee element which is calculated as a percentage charged according to the value of the goods. Furthermore, a gold deposit could offer an additional option instead of individual storage. In particular, those who value not being exposed to the risk of bankruptcy should avoid bank precious metal accounts, simply because they represent a bank debt which would then flow into the bankruptcy estate if the respective bank were then subject to insolvency proceedings.

The alternative option: Segregated individual storage of precious metals

Instead of a gold or silver account or a precious metal deposit, you can, of course, choose to invest your capital directly in physical precious metal bullion bars and coins. To facilitate this alternative, Swiss Gold Safe offers segregated individual storage of precious metals. This option is suitable for both physical gold and white metals, which also means the latter can then be stored VAT-free in a duty-free warehouse in Switzerland.

Swiss Gold Safe is a privately owned specialist company offering various storage solutions for precious metals and other valuables, without the need to maintain a precious metal account. This means your investment holdings will always remain your property: Even in the unlikely event that Swiss Gold Safe Ltd became insolvent, your ownership of the precious metals stored on your behalf would remain the same. Once your precious metals are stored individually with Swiss Gold Safe, unlike a precious metals account held with a bank, they cannot be deemed part of any bankruptcy estate.

Allocated and segregated storage at Swiss Gold Safe also facilitates the storage of specific precious metals, which are always registered using the respective bar- or seal numbers. In addition, individual custody offers many other advantages over collective custody. For instance, private storage providers are also not obliged to participate in data-exchange (CRS) or FATCA (Foreign Account Tax Compliance Act) protocols. This bank-independent and dealer-neutral storage arrangement is suitable for both Swiss citizens and international clients who wish to store precious metals in unlimited quantities for investment purposes, with their goods protected by comprehensive insurance cover.

An overview: Everything you need to know about precious metal accounts

- A precious metal account is an investment facility offered by many banks.

- Investors can purchase shares of gold, silver, platinum or palladium, and accumulate each specific holding via a dedicated account. Shares can be resold in the same way.

- When selling, investors will receive the appropriate monetary value. It may also be possible to take delivery of precious metals (for a fee) – provided this option is specified in the contract.

- A gold account is suitable for investors who wish to invest in precious metals but do not wish to be burdened with inventory management.

- According to the contract offer and the volumes involved, account management fees can be higher than the costs incurred for the maintenance of a safe deposit box. Fees are calculated as a percentage of the value of the stored goods.

- In the event of a bank insolvency, gold and silver accounts are considered a claim against the bank and treated as part of the bankruptcy estate. At best, investors receive a sufficient deposit guarantee.

- Segregated individual custody for physical precious metals at Swiss Gold Safe is a viable alternative. This bank-independent option carries no reporting obligations and will be exempt from any bankruptcy proceedings.